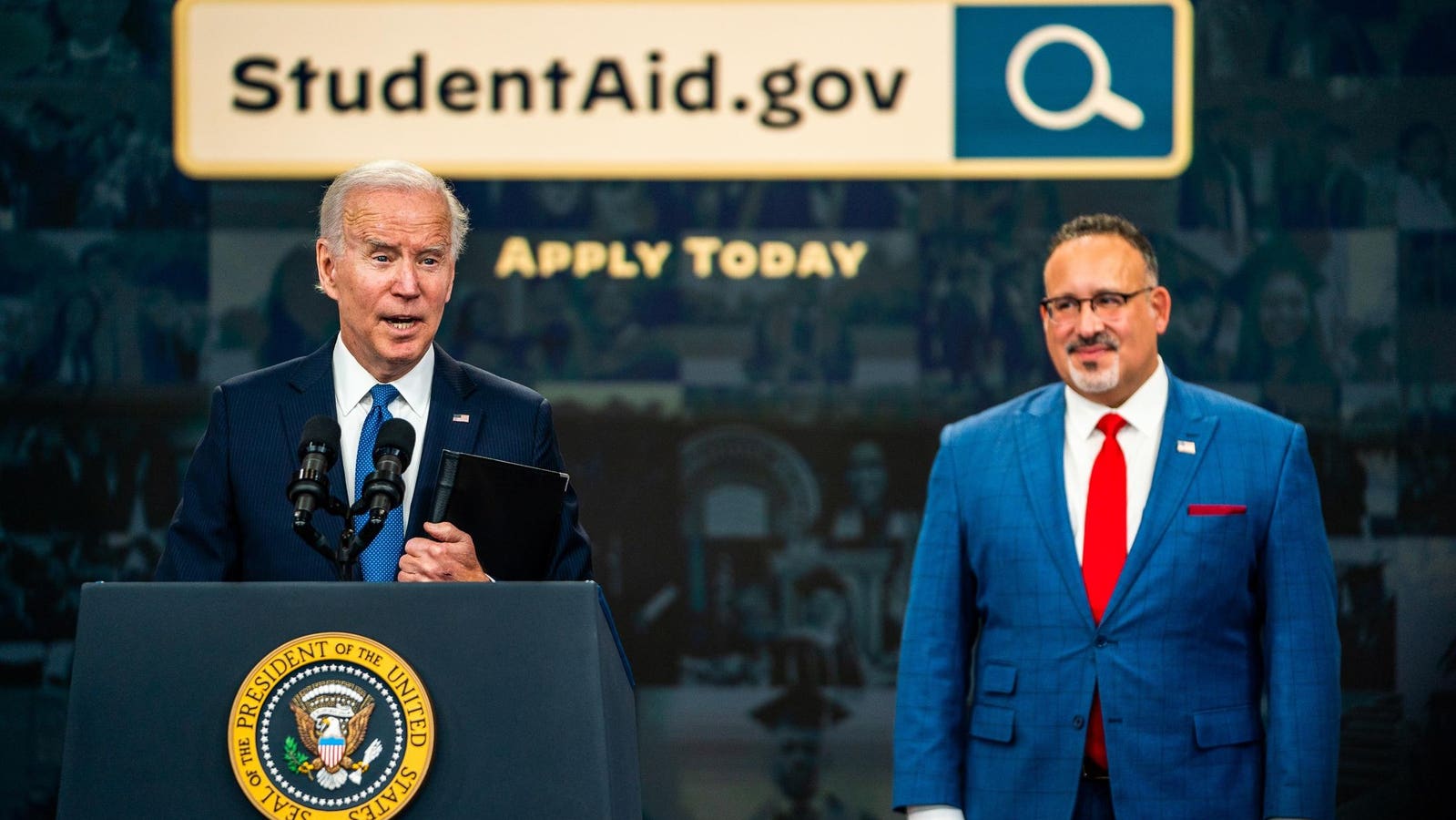

The Biden administration has resumed application processing for a key student loan forgiveness program geared toward public servants, according to an Education Department update.

Millions of borrowers had been stuck in limbo for months during a servicing transition for the Public Service Loan Forgiveness program. PSLF allows borrowers to qualify for loan forgiveness after making 120 qualifying payments — the equivalent of 10 years — while working for eligible nonprofit or public organizations. MOHELA, one of the department’s contracted loan servicers, had been been administering the PSLF program. But as part of a long-planned transition, the Education Department moved PSLF servicing from MOHELA to StudentAid.gov, and suspended processing during the transfer.

More than 900,000 borrowers had received student loan forgiveness under PSLF before the processing pause began in May. With the transition now complete, as of last week PSLF borrowers can now view qualifying payments again and receive approvals for discharges.

Here’s what borrowers need to know about the updates.

Transition Of PSLF Payment Counts For Student Loan Forgiveness Is Now Complete

Borrowers pursuing student loan forgiveness through the PSLF program had been able to review detailed information on their qualifying payments through their online MOHELA account. The Education Department and MOHELA update qualifying PSLF payment counts after borrowers submit PSLF employment certification forms, allowing them to track their progress toward eventual student loan forgiveness. But borrowers lost access to their PSLF data in May as the department began its servicing transition platform to StudentAid.gov.

But as of last week, the transition is now complete. Borrowers on track for PSLF can now review their qualifying payment information via their StudentAid.gov accounts.

“As of July 1, 2024, the PSLF program has successfully transitioned from the previous specialty servicer and now is fully managed by ED on StudentAid.gov,” said an Education Department update last week. “You can now see your progress toward PSLF on the My Aid section of your Dashboard when you log in to StudentAid.gov using your StudentAid.gov account username and password combination (sometimes called an FSA ID). The display will show your loan details, payment history (for PSLF months), and employment certification.”

Student Loan Forgiveness Processing For PSLF Is Resuming

The Education Department is also resuming processing student loan forgiveness for borrowers who have reached the 120-payment threshold for PSLF. Loan forgiveness processing had been paused during the three-month transition that began in May.

“As we are updating PSLF payment counts, we are also working to review approvals for forgiveness,” said the update. If borrowers are approved for student loan forgiveness, “You will first receive a notice from ED that you have been approved for forgiveness followed by a separate notice from your servicer once the discharge is complete.”

It can take up to 90 days for a borrower’s federal student loans to be discharged after their PSLF qualifying payment count has been updated to 120 or more.

Delays In Student Loan Forgiveness Processing Expected For PSLF

Advocates had warned that there might be significant delays in processing student loan forgiveness and updating PSLF qualifying payment counts after the servicing transition was completed. While the new Education Department update does not directly address delays, the announcement does indicate that officials are focusing on managing what is a likely backlog of PSLF applications.

“If you met the PSLF requirements for forgiveness before the processing pause that began on May 1, 2024, we are prioritizing approval for your discharge,” says the department. This suggests that borrowers who qualify for student loan forgiveness based on qualifying payments made during or after May 2024 will need to wait a bit longer for their PSLF forms to get processed and their student loan forgiveness to be approved. The department did not indicate how long the process may take.

Borrowers Can Request Forbearance While Student Loan Forgiveness Gets Processed

Those who are currently in repayment, but anticipate qualifying for student loan forgiveness through PSLF because they have made 120 or more qualifying payments, can consider requesting a forbearance. A forbearance would suspend monthly payments while keeping the loan in good standing. However, this can be risky, as interest would still accrue during the forbearance, and the period would not count toward PSLF if the application is ultimately rejected.

“If you believe you’ve reached 120 qualifying payments but the updates are not yet reflected in your StudentAid.gov account, you may contact your federal student loan servicer directly to request a forbearance,” says the updated Education Department guidance. “However, if your PSLF form doesn’t meet the program requirements and is denied, the forbearance period won’t count and any interest that accrued may be capitalized (added to the unpaid principal amount of your loan).”

Alternatively, borrowers can continue to make payments while waiting for their PSLF application to be processed and student loan forgiveness to ultimately get approved. “If you continue to make payments, any overpayments will either be applied to any other of your outstanding federal student loans or refunded to you,” says the department. However, while the department has issued payment refunds in the past, the process of actually getting refunded can sometimes be lengthy.

Read the full article here