Ever since I started saving for retirement in 1999, I’ve been a proponent of tax-deferred retirement vehicles like the 401(k) and skeptical of tax-now vehicles like the Roth IRA. Working in banking, I was already being taxed out the wazoo and had no desire to pay even more. Frankly, I wasn’t even familiar with the Roth IRA or the mega backdoor Roth IRA when I first started working.

The Roth IRA was established under the Taxpayer Relief Act of 1997 and became available to taxpayers on January 1, 1998. It was named after Senator William Roth of Delaware, a key advocate for this retirement savings vehicle.

Unlike traditional IRAs or 401(k)s, which use pre-tax contributions but require taxes on withdrawals, Roth IRAs are funded with after-tax dollars, allowing for tax-free withdrawals on qualified distributions.

Slowly Warming Up to the Roth IRA

In 1999, I had just landed my first job out of college. Retirement planning wasn’t my top priority. After maxing out my 401(k), I focused on growing my career and building a taxable brokerage account to one day buy property—my favorite asset class for building wealth.

Throughout my 20s and 30s, I stayed firmly against the Roth IRA. I was consistently in a federal marginal income tax bracket above 24%, so paying taxes up front felt like surrendering to an inefficient government that wastes hundreds of billions of taxpayer dollars annually.

However, in my early 40s, earning a much lower income after early retirement, I began to see the appeal of the Roth IRA. I even wrote a post titled Why I Didn’t Contribute to a Roth IRA But Why You Should as a way to make amends for my earlier stance.

The ability to let investments grow tax-free for decades and withdraw without any taxes is a powerful strategy for retirement income diversification. I see this benefit much more clearly now as I inch closer to traditional retirement age.

The Mega Backdoor Roth IRA: A Smart Move for Super-Savers

I don’t want to repeat my earlier mistake of dismissing the Roth IRA due to stubbornness or a lack of understanding. That’s why I decided to focus on the Mega Backdoor Roth IRA to see if it’s something we can take advantage of.

The Mega Backdoor Roth IRA is a three-step strategy that allows employees to contribute far more to their retirement plans than the standard limits. For example, in 2025, the employee 401(k) contribution limit is $23,500. Adding employer contributions, the total allowable contribution is $70,000. However, while employees can control their own contributions, they can’t dictate how much their employers contribute.

If you’re able to contribute the maximum $23,500 a year, that’s fantastic—only about 13%–15% of employees manage to do so. But with the Mega Backdoor Roth IRA, you can go beyond the employee maximum and save even more.

This strategy is ideal for high-income earners, super-savers, and personal finance enthusiasts looking to maximize their retirement wealth. Since you’re reading Financial Samurai, that’s likely you! For context, the median income for all U.S. households is about $80,100 in 2024, and $120,000 for married couples, according to the Census Bureau.

Why Use the “Backdoor”? Income Limits For Roth IRA Contribution

The main reason to explore the Mega Backdoor Roth IRA is the income limits for contributing to a standard Roth IRA. When I first started working in banking, I wasn’t eligible to contribute after my first year due to these restrictions. And it took me a full year of working before realizing the benefits of a Roth IRA.

Arbitrary income limits always struck me as counterintuitive. Shouldn’t the government encourage everyone to save for retirement, especially younger employees? The more people save now, the less they’ll rely on government support later.

Here are the latest Roth IRA income limits for 2025:

- Single filers: You can make a full Roth IRA contribution if your income is below $150,000.

- Married couples filing jointly: You can make a full contribution if your joint income is below $236,000.

If your income is higher:

- Single filers earning between $150,000 and $165,000, and joint filers earning between $236,000 and $246,000, can make a partial contribution.

- Single filers earning $165,000 or more, and joint filers earning $246,000 or more, are ineligible to contribute directly to a Roth IRA.

This is where the Mega Backdoor Roth IRA comes in, offering a way for high-income earners to bypass these restrictions and continue growing tax-free retirement savings.

How To Contribute To A Mega Backdoor Roth IRA

1) Employees start by maxing out their pre-tax 401(k) contributions, which the IRS recently announced will be $23,500 in 2025. For those 50 and older, there’s an additional $7,500 in catch-up contributions.

2) Next, they allocate more of their paycheck toward after-tax contributions within their 401(k) plan. For example, the employee contributes another $20,000 after-tax to their 401(k).

3) Finally, they convert those after-tax contributions to Roth status, either immediately or automatically if their plan allows. This ensures the contributions grow tax-free and can be withdrawn tax-free in retirement.

Pretty easy right? This strategy is particularly valuable for high earners who exceed the income limits for a regular Roth IRA. By leveraging their 401(k), they can save up to $70,000 in 2025—or $77,500 if they’re 50 or older—while taking full advantage of tax-free growth and withdrawals. These figures are total figures, including the employer’s contribution.

The problem is, not all employers and 401(k) providers provide the option to do a mega backdoor Roth IRA. Hence, you must ask your HR personnel for this option.

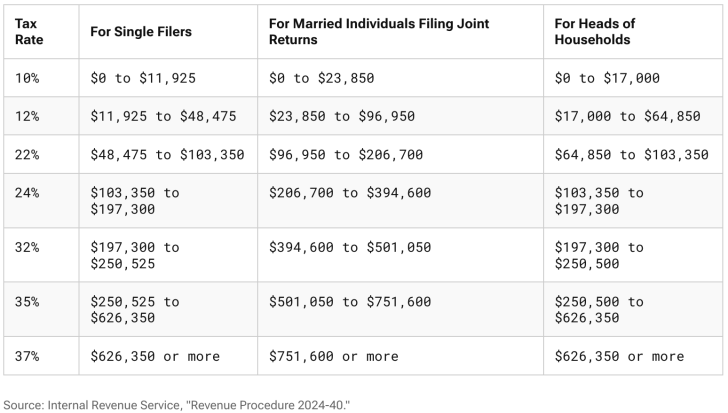

Knowing Your Marginal Federal Income Tax Rate Is Important For Mega Backdoor Roth IRA

Here’s the thing about contributing to a Mega Backdoor Roth IRA: once you earn over $197,300 as a single filer or $394,600 as a married couple, your federal marginal income tax bracket increases by 8%, bumping you up to the 32% bracket for 2025. From there, the brackets continue to climb, reaching 35% and eventually 37%.

Will you truly be excited about paying a 32% – 37% marginal federal income tax rate to grow your Mega Backdoor Roth IRA? The answer depends on your outlook for future tax rates and how much you expect to earn or withdraw once you hit traditional retirement age (60+).

With Trump as president, these marginal federal income tax brackets are likely to remain the same from 2025 to 2029. However, taxes could increase under the next president, which is why diversifying your retirement savings remains crucial.

Thoughts On Contributing To A Roth IRA By Tax Bracket

Here are my estimated probabilities for a positive outcome if you do a Roth IRA conversion or contribute to a Roth IRA at your current marginal federal income tax bracket. A positive outcome is defined as saving money on taxes.

- 10% tax bracket: 95% chance contributing or converting to a Roth IRA is the right choice

- 12% tax bracket: 90% chance contributing or converting to a Roth IRA is the right choice

- 22% tax bracket: 80% chance contributing or converting to a Roth IRA is the right choice

- 24% tax bracket: 70% chance contributing or converting to a Roth IRA is the right choice

- 32% tax bracket: 45% chance contributing or converting to a Roth IRA is the right choice

- 35% tax bracket: 40% chance contributing or converting to a Roth IRA is the right choice

- 37% tax bracket: 35% chance contributing or converting to a Roth IRA is the right choice

- 39.6% tax bracket: 20% chance contributing or converting to a Roth IRA is the right choice

The Key Reason To Contribute To A Mega Backdoor Roth IRA

The ultimate reason to follow through with a Mega Backdoor Roth IRA is that you would have to pay taxes on any amount over the 401(k) contribution limit anyway.

So, instead of paying taxes on your income and investing the money in a taxable brokerage account, why not contribute after-tax dollars to a Mega Backdoor Roth IRA and let the money compound tax-free? When it’s time to withdraw, all profits will be tax-free as well, unlike the taxable gains from a brokerage account.

When Can You Withdraw From A Mega Backdoor Roth IRA Penalty-Free?

You can withdraw contributions at any time. To be able to withdraw earnings tax- and penalty-free, the Roth IRA must be at least five years old, and you must meet the age requirement (59.5), or qualify for one of the exceptions like first-time home purchase, disability, or education expenses. So that’s a downside, having to wait until 59.5 if you want to use the money now to buy a house or something.

You’re also avoiding the annual taxes on dividends and interest that would otherwise be taxed in a brokerage account. Plus, you’ll also avoid capital gains taxes on any appreciation when you eventually withdraw from the Roth IRA. The ability to compound tax-free over time is a huge benefit.

Rolling the Mega Backdoor Roth funds into an existing Roth IRA account where the five-year rule has already been satisfied can help simplify and accelerate access to penalty-free withdrawals. Now let’s look at an example.

Example of a Penalty-Free Withdrawal from a Mega Backdoor Roth IRA

Scenario:

- Contributions: John contributes $20,000 in after-tax dollars to his 401(k) and immediately rolls it into a Roth IRA via the Mega Backdoor Roth strategy.

- Earnings: Over 10 years, these contributions grow to $35,000 due to investments.

- Account Age: The Roth IRA has been open for 10 years.

- Age: John is 60 years old.

Steps:

- John withdraws $35,000 from his Roth IRA:

- The $20,000 in contributions can be withdrawn tax-free and penalty-free at any time because they were after-tax contributions.

- The $15,000 in earnings is also withdrawn tax-free and penalty-free because:

- John is over 59½ years old.

- The account has been open for more than five years.

Outcome:

John can withdraw the entire $35,000 without paying any taxes or penalties.

Alternate Scenario: Early Withdrawal of Contributions Only

If John were 45 years old and needed $10,000, he could withdraw up to $20,000 of his contributions tax-free and penalty-free. However, withdrawing from the $15,000 in earnings would result in taxes and penalties unless he qualifies for an exception.

Best Income And Net Worth Combination For A Mega Backdoor Roth IRA

For those with high net worths and low incomes, you have the ideal combination for taking advantage of the mega-backdoor Roth strategy.

For example, let’s say you’re a 47-year-old single individual with a $3 million net worth, but one year you decide to leave your job in March and only make $48,000 for the whole year. You’re in the 12% marginal federal income tax bracket, which is quite reasonable. In this case, you should consider contributing the maximum $23,500 to your 401(k) employee contribution and then making an additional $24,500 in after-tax contributions to your 401(k).

Given your low tax bracket today, it’s very likely that the 12% rate you’re paying now will be lower than the rate you will face when Required Minimum Distributions (RMDs) start at age 73. This applies to retirement accounts like traditional IRAs, 401(k)s, and other tax-deferred retirement plans, as outlined in the SECURE Act 2.0.

By contributing to a mega-backdoor Roth IRA, you can take advantage of lower taxes now and avoid potentially higher taxes in the future. For income, you can hopefully live off the passive income your $3 million net worth generates.

Talk To Your Employer And Plan Provider

Every employee looking to supercharge their retirement savings should ask their employer and plan provider about the mega backdoor Roth IRA option. Yes, paying taxes upfront can feel painful, but remember, you would have had to pay those taxes on any contributions beyond the employee 401(k) limit anyway.

Happy mega retirement savings! When your knees start creaking and your back starts complaining, you’ll be glad you put in the work while you still had the energy.

Readers, is anyone already utilizing a mega backdoor Roth IRA? What are some potential downsides we should be aware of? And how do you decide how much to contribute to your taxable brokerage account or other taxable investments versus your mega backdoor Roth IRA?

Diversify Your Retirement Investments

Stocks and bonds are classic staples for retirement investing. However, I also suggest diversifying into real estate—an investment that combines the income stability of bonds with greater upside potential.

Consider Fundrise, a platform that allows you to 100% passively invest in residential and industrial real estate. With over $3 billion in private real estate assets under management, Fundrise focuses on properties in the Sunbelt region, where valuations are lower, and yields tend to be higher. As the Federal Reserve embarks on a multi-year interest rate cut cycle, real estate demand is poised to grow in the coming years.

I’ve personally invested over $270,000 with Fundrise, and they’ve been a trusted partner and long-time sponsor of Financial Samurai. With a $10 investment minimum, diversifying your portfolio has never been easier.

Last Call: Get A Free Financial Checkup + $100 Gift Card

For those with over $250,000 in investable assets who want a free financial checkup, you can schedule an appointment with an Empower financial professional here. If you complete your first call with the advisor before November 30, 2024, and your second call with the recommendations in December, you’ll receive a free $100 Visa gift card. I just checked with my contact at Empower.

With stocks at all-time highs and a new president with difference policies, it’s wise to get a second opinion from a professional. The last thing you want is to be misallocated relative to your financial goals and risk tolerance. When you lose money, you ultimately lose precious time.

The statement is provided to you by Financial Samurai (“Promoter”) who has entered into a written referral agreement with Empower Advisory Group, LLC (“EAG”). Click here to learn more.

To expedite your journey to financial freedom, join over 60,000 others and subscribe to the free Financial Samurai newsletter. Financial Samurai is among the largest independently-owned personal finance websites, established in 2009.

Read the full article here