In his new book, law professor Michael Graetz makes a provocative argument: The modern anti-tax movement is perhaps the most important U.S. political trend of the past half-century. And its power goes far beyond economics. It simultaneously affects and is driven by culture, as well as attitudes about race and government.

The book’s title pretty much says it all: The Power To Destroy: How the Anti-Tax Movement Hijacked America. Graetz argues that anti-tax conservatives not only lowered taxes, especially for high-income households and corporations, but they changed government and politics in profound ways. And that, he says, was their ultimate goal.

The Anti-Taxers Are Winning

The anti-taxers have, at least for now, won the debate. Federal budget deficits are massive and growing. U.S. tax rates are low. Promised Social Security benefits are at risk. The public overwhelmingly supports tax increases on the wealthy and corporations. Yet, Congress keeps cutting taxes and even many congressional Democrats are unwilling to raise them.

President Joe Biden has made tax increases on corporations and the very rich part of his brand. But even he vows to continue the tax cuts included in the 2017 Tax Cuts and Jobs Act, which apply to 95% of U.S. households.

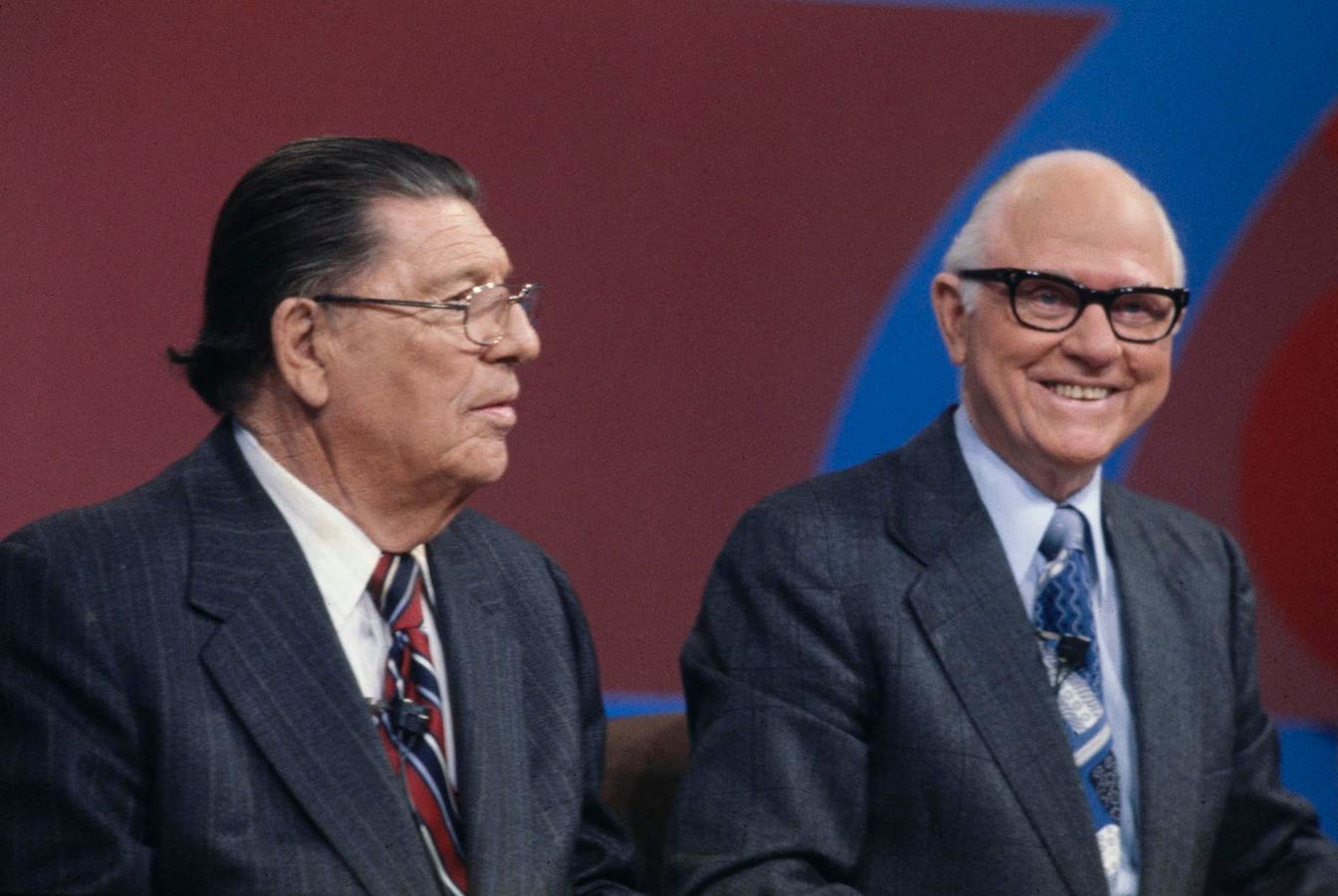

Graetz served in senior tax roles at the US Treasury Department in the George H.W. Bush administration and currently teaches tax at both Columbia and Yale law schools. But this is no technical legal tome. Rather, he describes in plain language how the anti-tax movement came about and what it means. His new book will be the subject of a Tax Policy Center program on April 3.

Prop 13

Americans have been complaining about high taxes since before the nation’s founding. But Graetz dates the modern movement to Howard Jarvis, a wealthy Californian and long-time anti-government political gadfly who hit on a winning issue in 1978. By almost a 2-1 margin, state voters adopted Proposition 13, a constitutional limit on property taxes.

In Graetz’s telling, many Prop 13 supporters had more than property taxes in mind. Much of its support came from opponents of immigration and school integration. Key backing came from evangelical Christians, who objected to IRS efforts to deny tax exemptions to segregated private schools.

The mash-up of culture and economics became a centerpiece of the anti-tax agenda. Many backers — including Newt Gingrich, Grover Norquist, and Rush Limbaugh, and now Donald Trump — successfully made taxes part of a broader anti-government narrative.

An Analytical Troika

Graetz argues their effort is built on an ideological troika that is analytically flawed but politically powerful.

The arguments: Tax cuts would generate so much economic activity that they’d pay for themselves, this economic growth would be created by reducing taxes for job-creating high-income people, and cutting taxes would inevitably shrink government.

The last one may have been the most consequential, and most wrong-headed. This “starve the beast” claim entirely misread Congress. While hardcore anti-taxers may have believed lawmakers would respond to a decline in tax revenue by cutting spending, even most Republicans had a different solution: Absent sufficient tax revenue to fund government, they’d merely borrow the money and spend anyway. Democrats, of course, were happy to go along.

Behind those quasi-economic arguments, there was hardcore politics.

If Democrats were going to entice voters with more spending, what could Republicans offer? Tax cuts, of course.

But at the root of it all was accumulation of power. Gingrich may not have cared that much about taxes, but he saw the anti-tax movement as his ticket to power. If members of the Democratic establishment favored taxes, he’d build his revolution opposing them.

For now, Graetz believes the anti-tax movement remains ascendent. And he’s not wrong.

The TCJA

Take the TCJA. In 2017, no Hill Democrats voted for the bill and in 2018 many campaigned against it as a giveaway to corporations and the wealthy. The Tax Policy Center concluded almost everyone got a tax cut, though high-income households and corporations benefited the most.

But that was then. Those tax cuts are due to expire at the end of 2025. The federal budget deficit this year is $1.6 trillion, per the Congressional Budget Office. TPC estimates that extending the law’s individual tax cuts would add another $3.5 trillion to the nation’s debt over the next 10 years.

It seems like an ideal opportunity to think about scaling back the TCJA’s largess. Yet, Biden and many congressional Democrats say they’ll extend the tax cuts for those making $400,000 or less — again, about 95% of all U.S. households.

On the other hand, Biden fell only two Senate Democratic votes short of winning approval for major tax increases on the ultra-wealthy and corporations. The anti-tax movement’s hold on lawmakers is fragile.

The coming election is likely to revolve mostly around the personas of Trump and Biden. But 2024 voters will have a lot to say about the future of tax policy, and the anti-tax movement, especially given the coming expiration of those TCJA tax cuts.

Read the full article here